We recognise the importance of our impact on society and the environment and seek to engage in responsible investment through the enhancement of sustainability practices.

Since 2007, Magnum has invested in Iberia with the objective of creating value by building stronger, better companies, not only to generate superior returns for our investors, but also to create value to other stakeholders such as employees, governments and other social organizations.

As members of society and the modern economy, both Magnum and its portfolio companies have a responsibility to participate in driving economic, social and environmental progress and building better and safer communities. Additionally, we strongly believe that responsible investment, both applied in our company selection process and during the entire investment lifecycle, can be an important driver of financial value creation.

We are convinced that by enhancing economic activity, innovating, creating jobs and driving tax revenues and social contributions, we may play a significant role in improving the societies where we operate, which is crucial to creating and protecting long-term value at our portfolio companies and delivering investors’ financial expectations.

We invite you to learn more about our responsible investment policies and how we manage sustainability matters, as well as share any suggestions or request historical reports by sending an email to esg@magnumpartners.com.

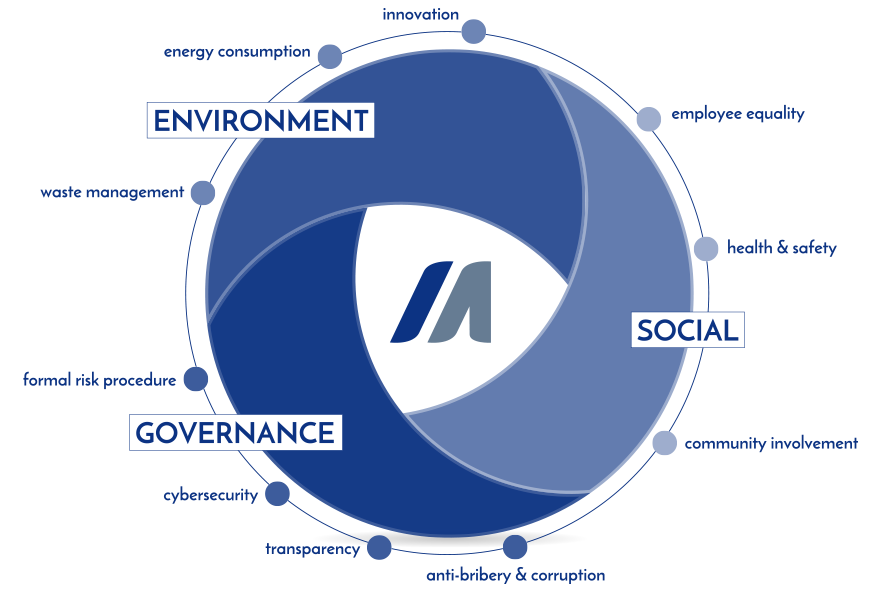

Magnum considers itself an active shareholder and industrial partner and as such, applies an active, disciplined and transparent approach to enacting responsible investing principles. We recognize the importance of our impact on society and the environment and therefore seek to include sustainability and environmental, social and governance (ESG) criteria in all stages of our decision-making and investment processes by:

• Using sustainability considerations to steer investment decisions, including avoiding investing in companies whose businesses run counter to our nonfinancial values and ethical principles.

• Adopting strict control measures that go beyond regulatory compliance in areas such as environmental stewardship, consumer protection, human rights, and racial and gender diversity.

• Setting targets, designing initiatives and monitoring level of performance on nonfinancial objectives across our portfolio companies.

• Providing investors and other stakeholders with timely information on sustainability-related topics, and publicly disclosing the most significant aspects of our responsible investment commitments.

More information available in our

Sustainable Investment Policy.

Every team member and committee at Magnum is aware of the firm’s commitment to responsible investing and is therefore responsible for incorporating said principles to his, her or its respective activities, contributing to the development of the organisation’s sustainability approach and stewardship activities.

Additionally, a Sustainability Committee has been appointed for ensuring due consideration and attention is given to these matters and that sustainability policies, systems and procedures are embedded in Magnum’s and its portfolio companies’ decision-making processes. The Committee will review and, where necessary, update the Responsible Investment Policy to reflect on-going efforts, emerging requirements from stakeholders and evolving good practices and to improve the organization’s Responsible Investment approach.

The Committee comprises members across departments and seniorities to maximise diversity of perspectives and allow the firm to form a broader and richer vision of responsible investing related issues.

Since 2014, Magnum is a signatory of the United Nations Principles for Responsible Investment. Its performance is assessed by PRI on an annual basis and benchmarked against peers in the industry. The consistently strong results reflect Magnum’s commitment to said principles.

Magnum is committed to complying with the best practices of the ILPA guidelines on effective private equity partnership: alignment of interest, governance and transparency.

Additionally, Magnum proudly endorses initiatives for the achievement of UN Sustainable Development Goals, including climate and environment-related initiatives like the Paris Agreement and the Task Force on Climate-related Financial Disclosures (TCFD), and organizations improving gender diversity in the private equity industry such as Level 20.

The Sustainability Information included herein only relates to MAGNUM CAPITAL IV SCA SICAV-RAIF (the Fund), a Luxembourg partnership limited by shares incorporated as a société d’investissement à capital variable – fonds d’investissement alternatif reserve, registered with the Luxembourg Trade and Companies Register under number B288267, for which Magnum Initial Investors S.à r.l. (the General Partner, a private limited company registered with the Luxembourg Trade and Companies Register under number B286711) acts as managing general partner, and who has appointed CSC Fund Management (Luxembourg) S.à r.l. (the AIFM) as the external and authorised alternative investment fund manager within the meaning of the Directive 2011/61/EU of the European Parliament and of the Council of 8 June 2011 on alternative investment fund managers, being in charge of the portfolio and risk management.

Magnum Industrial Partners Tres, S.L. acts only as investment advisor providing investment recommendations and other advisory services to the General Partner, the Fund and/or the AIFM, and therefore, this Sustainability Information is provided by Magnum Industrial Partners Tres for disclosure purposes only and does not relate to any other entities than the foregoing.